Council discusses ice storm gaps in city's winter weather response

Environmental Quality and Public Works Commissioner Nancy Albright said that the city was prepared for a normal snow event, not an ice storm.

Lexington's economy is slated to continue to grow, but at a slower pace than the last few Fiscal Years.

In Tuesday, February 28th's Budget, Finance, and Economic Development (BFED) Committee, Dr. Michael Clark of the University of Kentucky Center for Economic Research will present a forecast of future City revenue from the Payroll Withholding tax and the Net Profit tax.

The Payroll Withholding tax and Net Profit taxes are the two largest revenue sources for Lexington’s General Fund.

Every February, as the Mayor’s Administration begins work on the Mayor’s Proposed Budget for the upcoming Fiscal Year, UK’s Center for Economic Research provides forecasts for how much money the City can expect from these two revenue sources over the next fiscal year.

Since both taxes account for over 60% of the City’s revenue, this presentation sets expectations for how large or small the upcoming Budget could be.

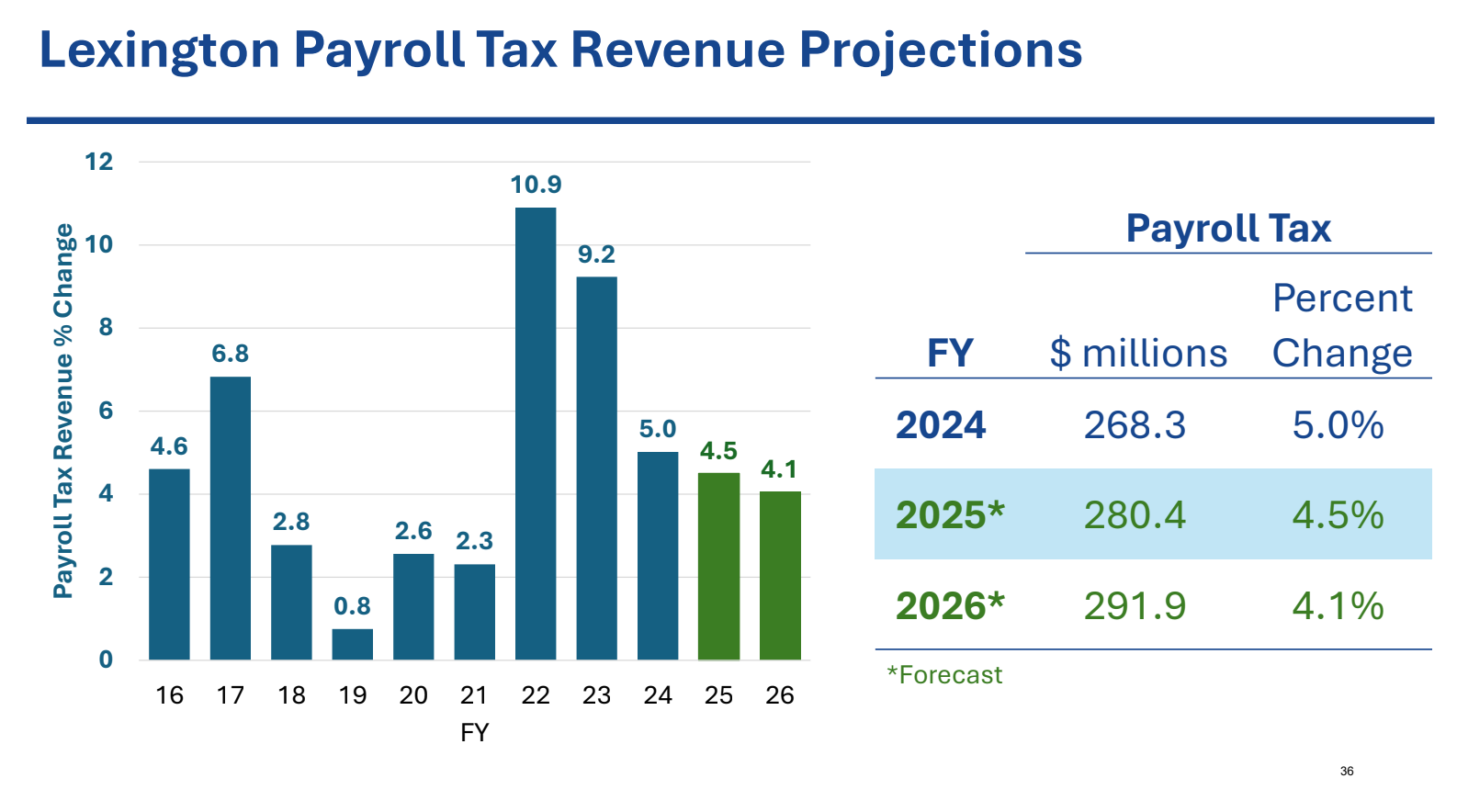

Lexington’s Payroll Withholding Tax revenue grew sharply in the first few years after the COVID-19 pandemic, consistently bringing in more revenue than the City anticipated. The overperformance was the result of high wage growth and more jobs coming back into the economy.

However, while Payroll Withholding Tax will continue to grow, UK projects that the rate of growth will be much slower than has been the case post-COVID.

Fiscal Year 2026 is projected to bring in $280.4 million in Payroll Withholding Revenue. This represents a 4.1% growth in revenue from FY25, which is expected to bring in $280.4 million in revenue.

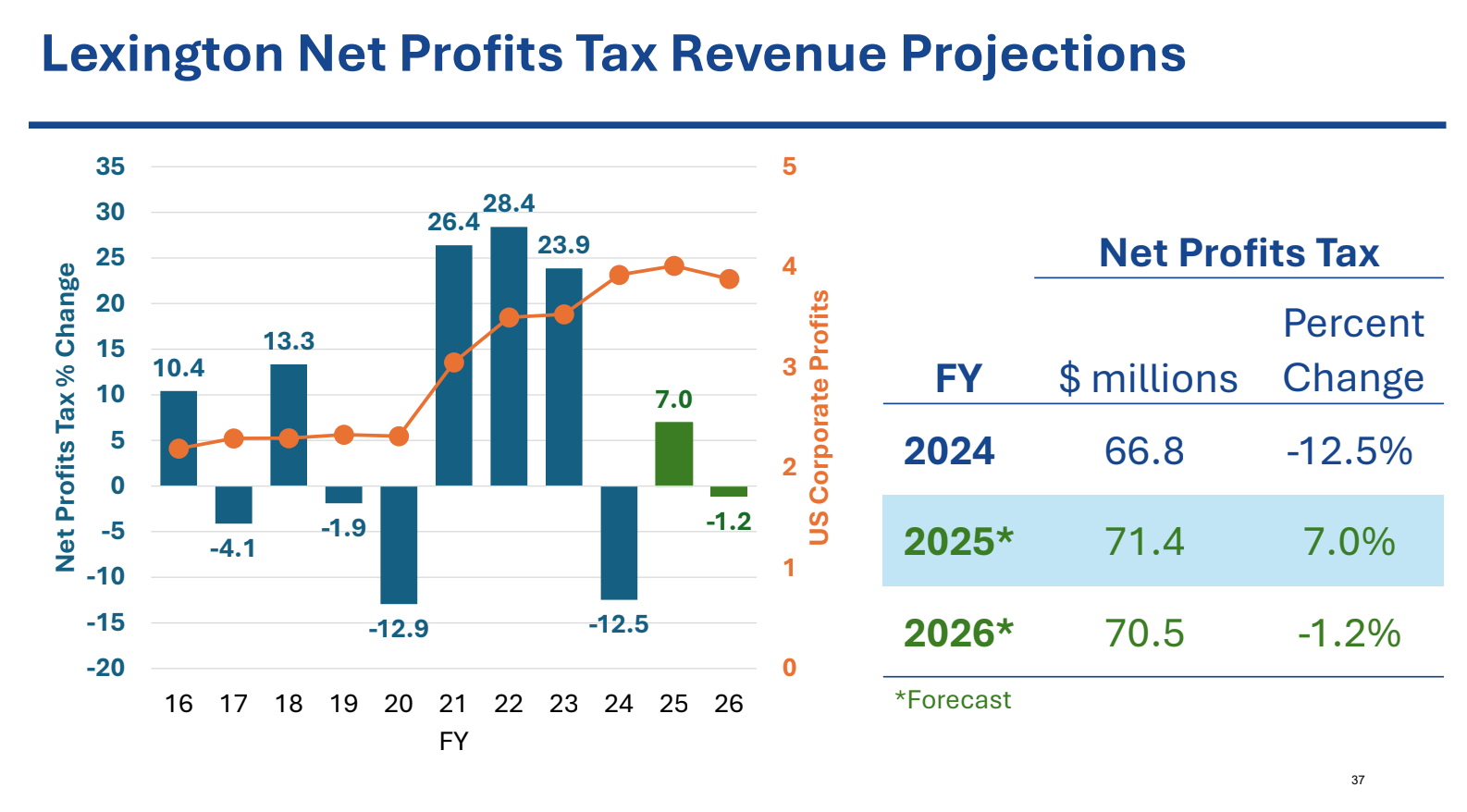

Net Profit Taxes are expected to drop in both raw number and percentage growth. FY26 is expected to bring in $70.5 million, a -1.2% drop from the $ 71.4 million FY25 is on track to bring in.

Net Profit taxes are harder to forecast for than Payroll Withholding, and do not grow consistently like Payroll Withholding grows.

At the same time that revenue has and will continue to grow more slowly, the Mayor’s Administration has taken a different approach to budgeting than in past years. In the FY25 Budget, the Administration tried to make a tighter budget that more accurately projected not just how much revenue the City would earn, but also how much it would spend.

Several post-COVID budgets ended up having large surpluses coming from not only additional revenue, but also from less money being spent than planned for in the budget. That meant there was usually a good bit of leftover money that the Administration could carry over into the next Fiscal Year.

In the FY25 Budget, though, the Administration cut operating costs for most Divisions and Departments to prevent a large surplus. The FY25 Budget has not had many large variances in revenue nor in expenses so far, meaning the tighter approach has worked in the way the Administration intended.

But that also means that the FY26 Budget will not likely have much leftover money from FY25 being brought in, and will therefore be more reliant on the Payroll Withholding and Net Profit taxes than past post-COVID budgets — and again, these taxes are growing much more slowly.

The FY26 Budget then, while likely being larger than the FY25 Budget, will probably not be much larger, and could be much less flexible with regard to how the Administration and the Council chooses to spend the money it has.